The disruptive innovation is probably one of the most important innovation theories of the last decade. The core concepts behind it circulated so fast that already in 1998, one year after the publication of the theory, people were using the term without making reference to Harvard professor Clayton Christensen or to his book The Innovator’s Dilemma (Harvard Business School Press).

This article is the seventh part of the Innovation Management Theory series, you can check the previous six clicking here.

Disruptive Innovation

The term disruptive innovation as we know it today first appeared in the 1997 best-seller The Innovator’s Dilemma. In the book Harvard Business School professor Clayton Christensen investigated why some innovations that were radical in nature reinforced the incumbent’s position in a certain industry, contrary to what previous models (for instance the Henderson – Clark model) would predict. More specifically he analyzed extensively the disk drive industry because it represented the most dynamic, technologically discontinuous and complex industry one could find in our economy. Just consider that the memory capacity packed into a square inch of disk increased by 35% per year, from 50 kilobytes in 1967 to 1,7 megabytes in 1973, 12 megabytes in 1981 and 1100 megabytes in 1995.

Christensen describes how one of his friends was responsible for that choice when he commented that “those who study genetics avoid studying humans because new generations come along only every thirty years or so, it takes a long time to understand the cause and effect of any changes. Instead, they study fruit flies, because they are conceived, born, mature and die all within a single day. If you want to understand why something happens in business, study the disk drive industry. Those companies are the closest things to fruit flies that the business world will ever see”.

Sustaining vs. Disruptive Innovation

The central theory of Christensen’s work is the dichotomy of sustaining and disruptive innovation. A sustaining innovation hardly results in the downfall of established companies because it improves the performance of existing products along the dimensions that mainstream customers value.

Disruptive innovation, on the other hand, will often have characteristics that traditional customer segments may not want, at least initially. Such innovations will appear as cheaper, simpler and even with inferior quality if compared to existing products, but some marginal or new segment will value it.

The disk drive industry

The first disk drive was developed in IBM’s San Jose research laboratories, around 1954. It was as large as a refrigerator and it could store 5 megabytes of data. By 1976 $1 billion worth of disk drives was being produced annually, divided between integrated producers (IBM, Control Data, Univac, and others) and OEM producers (Nixdorf, Wang, Prime, and others).

By 1996 the disk drive market was worth $18 billions, but out of the many companies that were operating in 1976 only IBM was still in the market. About 129 firms entered the market during that period, and 109 of them ceased to exist. Most of the technological discontinuities that emerged in the industry were sustaining innovations. For example in the 1970’s the oxide disks started to reach a physical limit (in terms of bytes of information contained), forcing the leading companies to develop an alternative. IBM, Control Data and other incumbents invested more than $50 million developing thin-film coatings, and virtually all of the established firms managed to keep their position in the face of such sustaining innovation.

In contrast, there have been very few disruptive innovations over the same period, but those were responsible for the downfall of established firms. As Christensen highlights the most important disruptive technologies were the architectural innovations that shrunk the size of the drives, from 14-inch diameter disks to 8’, 5.25’ and 3.5’, and then from 2.5’ to 1.8’.

The passage from 14-inch to 8-inch disks

The 14-inch disk drives were produced to supply mainframes, and the two parameters mainframe producers would consider as a performance measure were the capacity and the cost per megabyte. Around 1980 some new firms ( including Micropolis, Priam and Quantum) developed smaller 8-inch drives, but those packed 10 to 40 megabytes of capacity while mainframes were demanding 400 megabyte drives. The leading companies producing 14-inch drives could have developed 8-inch drives internally without much of a trouble, after all the technological innovation involved was simple and architectural in nature. Why they did not, you might ask? Because their main customers, the mainframe manufacturers, were not interested at all in the smaller hard drives.

The new entrants would not be able to sell the 8’inch drive for mainframe producers; consequently they were forced to look for new applications that would eventually value the characteristics of their product, mainly the reduced size. They found such application in the minicomputer. Manufacturers likes DEC, Prime and HP were willing to pay a higher cost per megabyte in order to get smaller disk drives.

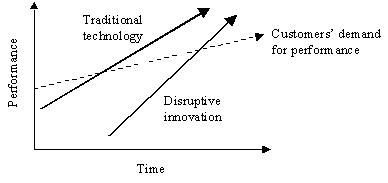

Customer demand for capacity was growing at 25% every year, while producers of 8’inch disk drives found that with sustaining innovations they were able to increase their disk capacity by 40% every year, almost twice as fast. Notice that most disruptive innovations will improve faster than what is demanded by mainstream customers, meaning that after some time disruptors should be able to attack established firms as the figure below illustrates.

After some years the 8-inch drives were offering an inferior cost per megabyte than 14-inch ones and the capacity was already enough to supply lower-end mainframes. The incumbents of the 14-inch generation witnessed their markets being invaded; and obviously it was too late to react. Only one third of 14-inch producers managed to make the transition into the new technology, but eventually all of them went out of the market.

The story repeats itself

The same pattern was observed when Seagate introduced the 5.25-inch disk drive, its capacity of 10 megabytes was of no interest to microcomputer producers. Seagate and the other 5.25-inch drive producers (Computer Memories, International Memories, Miniscribe and others) needed again to find a new application for their product. As Christensen writes “they went by trial and error, selling drives to whomever would buy them”.

The application was found in the desktop computers, and just like with under the 8-inch generation 5.25-inch disk drives improved their performance via sustaining innovations faster than what minicomputer customers were demanding. After a couple of years 5.25 drives invaded the 8-inch market, and virtually all the leaders under the 8-inch technology struggled out of the market.

By now I think you are already guessing what happened when the 3.5-inch disk drives emerged right? Almost all of the established players under the 5.25 generation were again forced out of the market.

What are the reasons?

How could we possibly explain such pattern? Clearly it was not a matter of technological complexity, incumbents were perfectly able to cope with the architectural innovations that shrunk the disk drive sizes. Some of the leading 5.25-inch producers even developed the 3.5-inch drives internally before new entrants, but they shelved the innovation as soon as their mainstream customers demonstrated no interest in them (5.25 drives were used for desktop computers while the 3.5-inch ones would be employed in notebooks). According to Christensen the crucial factor to understand is the concept of value network, described as “the context within which a firm identifies and responds to customers’ needs, solve problems, procure inputs, react to competitors and strive for profits”.

First of all, operating under such value network might lead a company to “listen too much” to its main customers. As a result it will not recognize potentially disruptive innovations that serve only marginal customers. Secondly large companies will not be interested in small markets; they hardly offer significant growth opportunities. Again this will lead companies to completely ignore the disruptive innovation or to wait until the market is “large enough to be attractive”. That is exactly when new entrants attack incumbent’s turf, and by that time it is usually too late.

What is a possible solution?

In order to solve both of these problems organizations should create an independent business unit whose size matches the emerging market. Quantum Corporation, a leading producer of 8-inch drives, recognized that 3.5-inch drives could have some applications in the computer industry, but they were not sure what those applications were exactly. Instead of shelving the project they created a spin-off unit to develop such 3.5.inch drives. After ten years the 8-inch market had completely disappeared while their small venture had grown to become the world largest disk drive producer.

Other examples of disruptive innovations:

- telephone (disrupted the telegraph)

- semiconductors (disrupted vacuum tubes)

- steamships (disrupted sailing ships)

Comments are closed.